McCormick urges Trump administration to retaliate against Norges Fund’s BDS move

The Pennsylvania senator suggested tariffs, visa sanctions and restricting Norway’s market access should be ‘on the table’

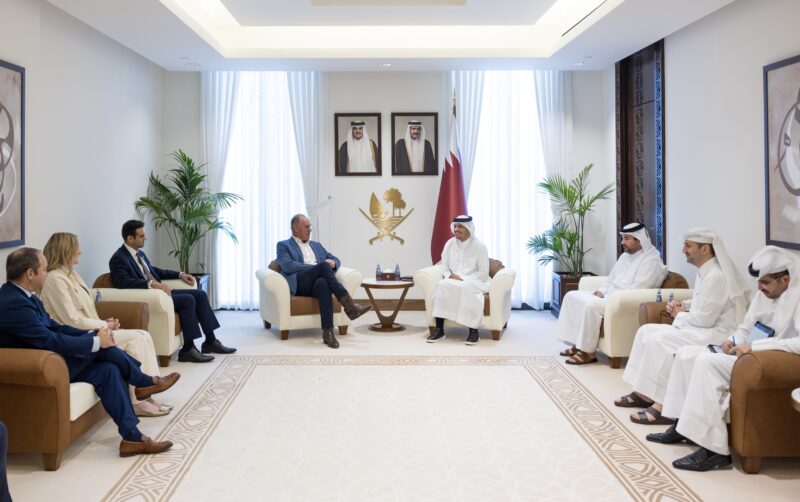

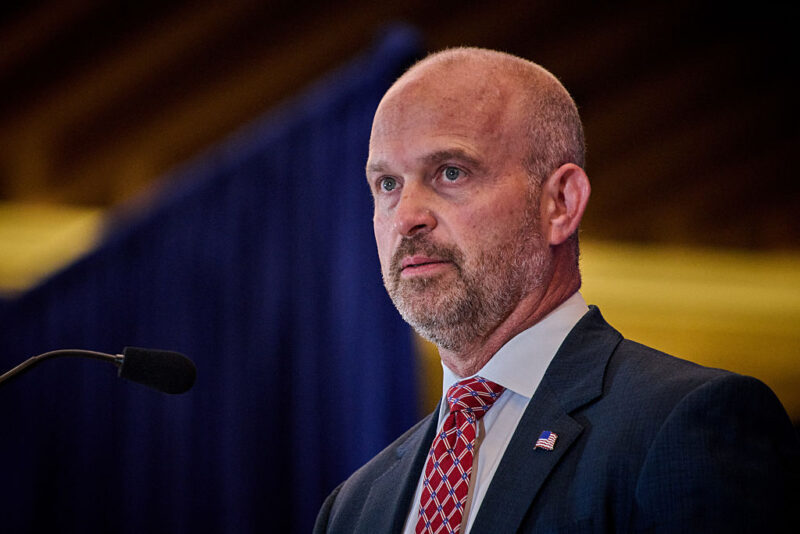

Israel on Campus Coalition/X

Rep. Dave McCormick (R-PA) speaks at the ICC National Leadership Summit in Washington on July 29, 2025.

Sen. Dave McCormick (R-PA) wrote to top trade officials in the Trump administration urging them to take action to respond to the decision by the Norges Bank Investment Fund, Norway’s sovereign wealth fund, to divest from U.S. equipment firm Caterpillar because of the Israeli military’s use of its products in the West Bank and Gaza.

“As the Trump Administration continues to take bold action to rebalance global trade, I urge you to also address the disturbing politicization of sovereign wealth fund investment decisions against American companies,” McCormick said in a letter, sent Thursday, to Commerce Secretary Howard Lutnick and U.S. Trade Representative Jamieson Greer.

He called on the administration to take Norges’ moves against American companies into account in ongoing trade negotiations with Norway, calling the effort a “form of economic warfare directed by a foreign government against the U.S. economy.”

He said that “all options should be on the table to address this issue,” including tariffs, “restrictions on Norges’ access to U.S. financial markets, and visa sanctions” on those involved in moves against American companies.

McCormick served from 2020-2022 as CEO of Bridgewater Associates, which manages portions of Norges’ portfolio. Bridgewater CIO Greg Jensen addressed Norges’ 2024 investment conference.

Sen. Lindsey Graham (R-SC) called publicly for similar retaliatory action last week.

McCormick said he’d confronted Norway’s prime minister about the Caterpillar decision during a visit to the country last month, and said the prime minister had told him the decision “merely followed Norges’ ethical guidelines and was not political.”

“I respectfully disagree. While I recognize the value of Norges’ investments of nearly $1 trillion of U.S. assets, I have significant concerns that these decisions are entirely political and are driven by an agenda that has consistently targeted American companies and is explicitly anti-Israel,” McCormick continued.

McCormick emphasized that Caterpillar is a frequent target of the Boycott, Divestment and Sanctions movement targeting Israel, and noted that Norges has also previously divested from U.S. fossil fuel and defense companies — in some cases including companies that Norway itself purchases weapons systems from.

The Pennsylvania senator called on the administration to “look more broadly at instances of sovereign wealth funds adopting restrictive, unfair trade policies against U.S. companies as a result of political pressure” in other cases as well.

McCormick separately wrote to Norway’s ambassador to the United States, stating that he “remain[s] extremely concerned” by Norges’ moves against American companies, adding that he “brought this issue up directly with Prime Minister [Jonas Gahr] Støre and was unsatisfied with his response.”

The Commerce Department did not respond to a request for comment on whether it plans to address Norges’ divestment from Caterpillar.

Richard Goldberg, a senior advisor at the Foundation for Defense of Democracies and former Trump administration official, said that Norges’ decisions have a significant impact on global investment trends.

“Norges is such a large player … It moves capital markets with its decisions,” Goldberg explained. “It causes other sovereign wealth funds, pension funds to follow. It causes institutional investors to follow. It really does set trends in investment and an inversion of capital can have impacts.”

He said that Norges’ investment decisions in relation to Israel are a major political issue in Norway’s upcoming elections, and some of the left-wing parties who could become part of the next governing coalition are demanding divestment from a “laundry list” of other American companies over their relations to Israel.

Goldberg also argued that the “danger of weaponized sovereign wealth funds” both in terms of BDS efforts and other anti-American moves is an ongoing and growing issue, and that the administration should insist that sovereign wealth funds be covered in U.S. trade deals with foreign countries.

“This is a long standing attack on U.S. interests, attack on American energy companies, an attack on American defense companies and now an attack on any company that does business with the State of Israel — all of this to the detriment of our national economic security, all of it politicized by the Norwegians by a state-run, state-controlled entity” Goldberg said.

If the U.S. fails to respond, he continued, “we’re literally allowing supposed democratic allies for whom we provide a blanket of freedom the ability to conduct economic warfare against America and American interests.”